April 12, 2025

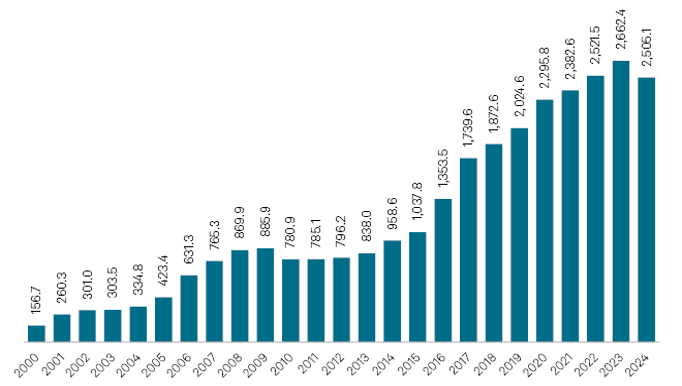

With constant headlines about trade wars, economic uncertainty, interest rate swings, geopolitical tensions and market volatility, it’s hard not to get distracted—or even worried—about market timing. But the reality is, there’s always something happening in the world that can make it feel like now isn’t the right time. Over the past 30+ years, since our firm’s founding in 1993, we’ve seen recessions, pandemics, natural disasters, wars, political unrest and financial crises—yet great companies still sell. The best time to sell is not when the market is calm (because it rarely is), but when your business is strong and you’re personally ready.

| Year | Event |

|---|---|

| 2025 | Tariff-driven trade war & stock market volatility |

| 2024 | U.S. election uncertainty |

| 2023 | Interest rate spikes leading to banking system stress (SVB & Credit Suisse failures) |

| 2022 | Russia-Ukraine war |

| 2021 | Supply chain crisis & inflation surges |

| 2020 | COVID-19 pandemic & stock market crash |

| 2016 | Brexit & U.S. election uncertainty |

| 2015 | Chinese stock market crash |

| 2014 | Oil prices collapse & Russia annexes Crimea |

| 2013 | Government shutdown |

| 2011 | U.S. debt ceiling crisis & S&P downgrades U.S. credit |

| 2010 | European debt crisis |

| 2009 | Great Recession |

| 2008 | Global financial crisis & Lehman bankruptcy |

| 2007 | Subprime mortgage crisis starts |

| 2005 | Hurricane Katrina & oil prices spike |

| 2003 | Iraq War begins |

| 2002 | Corporate scandals (Enron, WorldCom) |

| 2001 | 9/11 terrorist attacks & recession declared |

| 2000 | Dot-com bubble bursts |

| 1998 | Russian debt default |

| 1997 | Asian Financial Crisis |

| 1995 | Barings Bank collapse |

| 1994 | Bond market crash & Mexico peso crisis |

While market volatility may cause periods of hesitation, M&A markets remain active—especially for high-quality businesses. Private equity groups and strategic buyers often see uncertain environments as an opportunity to deploy capital.

At Woodbridge, A Mariner Company we are not seeing a slowdown in buyer interest. While the headlines may focus on volatility, we are not experiencing widespread pressure on valuations or multiples. Buyers remain aggressive for well-run, profitable companies with strong fundamentals.

Each year can bring unforeseen events impacting market conditions. Even in turbulent times, there’s a robust market for quality companies. If your business is strong and you’re personally ready, you don’t need to wait for “perfect conditions”—you need the right buyer and a sound strategy. By focusing on the health of your business and your personal preparedness, you position yourself for a successful sale, irrespective of external uncertainties.

If you’re considering your options—or you’ve received interest in your business—and want to understand the current market, valuation potential, and how to prepare, now is a great time to start the conversation.

Larry Reinharz – lreinharz@woodbridgegrp.com / (203) 389-8400 x209

Don Krier – dkrier@woodbridgegrp.com / (203) 389-8400 x201

Neil Dennis – ndennis@woodbridgegrp.com / (203) 389-8400 x228